Unit economy: what it is and how to calculate it

TABLE OF CONTENTS

Profit.Store

577

Unit economics is the accounting of the direct income and expenses of a particular business measured per unit of output. This unit can be any product or service that can be quantified and adds value to the business. The use of unit economics calculations makes it easier to forecast key indicators such as break-even point and gross profit. It is likely that most companies use the concept of unit economics, at least at a basic level, even if they are not aware of the term. However, a deeper understanding and effort is required to fully exploit the benefits of the unit economics model.

What is unit economics?

The success of any business is challenging and often difficult to estimate accurately. However, the concept of unit economics provides a simple approach to assessing profitability by analysing the costs associated with each individual unit or customer and comparing them with the revenue generated from that customer or unit.

In unit economics, a 'unit' is defined as a customer, product, service or other item for which the costs and revenues associated with its sale can be calculated.

For example, for a retailer, unit economics is defined as the profit it makes on each sale to each customer divided by the costs associated with that sale.

Similarly, for a ride-sharing platform, unit economics is calculated as the revenue generated by each individual ride divided by the costs associated with that ride.

In general terms, unit economics answers the key question: can a company generate more revenue from each customer than it costs to acquire them? This simple but important principle is becoming an essential tool for entrepreneurs, start-ups and businesses. It helps to evaluate a business model, determine which customers or products are most profitable, predict future profits and optimise the use of resources.

Synonyms

- Unit profitability: The profitability of each individual unit (i.e. the customer's unit economics).

- Cost of Goods Sold (COGS): The costs associated with producing and delivering products or services.

- Customer Acquisition Cost (CAC): The total cost of acquiring a new customer.

- Customer Lifetime Value (LTV): A measure of the revenue generated by an individual customer.

- Unit economics ratio: A ratio that measures the profitability of each business unit, calculated by dividing revenues by expenses.

Why is Product Unit Economics important?

Assessing the efficiency, profitability and overall health of a business is often a task faced by the management of a company. Economic analysis plays an important role in business strategy and customer acquisition from a number of perspectives.

1. Reflect the company's current progress in the context of each individual customer or business unit. When communicating with investors, stakeholders or board members, financial metrics illustrate the company's success at an individual and group level.

2. Support decisions to increase or decrease production or service levels. The financial feasibility of expanding a product or functionality can be determined by estimating the number of new customers that can be attracted and setting the optimal price for such products.

3. Allows entrepreneurs and start-ups to determine which customers or products are most valuable in the early stages. For SaaS companies, quickly understanding which customers bring in the most revenue helps to better target sales, marketing and product development efforts.

4. Unit economics allows you to accurately predict future business profits and expenses. However, poor data quality can lead to annual losses. Unit economics simplifies the assessment of these risks by providing specific indicators that facilitate decision making.

5. Unit economics provides important information on the profitability and cost-effectiveness of different strategies. It helps to accurately define and implement models to optimise revenues and reduce costs with greater precision.

6. Provides companies with information on the capital required to break even. When developing pricing strategies, unit economics can help determine the minimum price needed to break even.

7. Shows companies how much capital they need to break even. When developing pricing strategies, unit economics can help determine the minimum price that needs to be set to break even.

8. Aims to optimise the use of resources to minimise waste. By analysing product unit economics, companies can identify areas of inefficiency and implement changes to optimise processes.

Unit economics indicators

The unit economics of a product is defined as the ratio of consumer profit to purchase price. However, there are several factors that affect the final cost of a product.

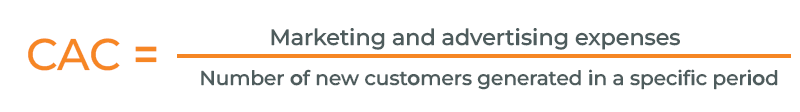

1. Customer Acquisition Cost (CAC)

Customer Acquisition Cost (CAC) is the amount of money a company spends to acquire a new customer. This calculation includes general marketing costs, advertising costs, staff, programmes, etc.

To calculate CAC, you can divide the total marketing and sales costs by the number of customers acquired.

This is the sum of all customer acquisition costs, including:

- Advertising, PR and marketing expenses: include expenses for advertising campaigns, public relations and sales promotion activities.

- Sales and distribution expenses: include salaries, commissions and other compensation for employees involved in the sales process.

- Technology costs: include the cost of software and hardware used to facilitate the customer acquisition process.

- Overheads: Utilities, rent and other overheads associated with lead generation activities.

- Variable costs: Includes shipping costs, payment processing fees and other variable costs associated with the customer purchase process.

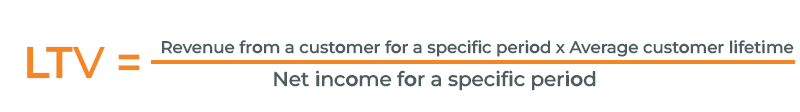

2. Customer Lifetime Value (LTV)

Customer Lifetime Value (LTV) is the average amount of money your business earns from a single customer throughout their time with you. In the case of SaaS (Software as a Service), LTV is calculated as the amount of money you earn from the moment a customer signs up until the moment they cancel their subscription and stop using your service.

This metric determines the potential long-term return on investment in customer acquisition in the product unit economy. It is the key metric that is analysed along with the company's cost of customer acquisition (CAC) to determine the profitability of a customer.

LTV calculation methods:

- For subscription services, the average monthly recurring revenue (MRR) per user is multiplied by the average customer lifetime to determine the total revenue per customer over the lifetime of the service.

- For e-commerce companies, it is the average order value multiplied by the average purchase frequency.

- For software companies, it's the sum of annual revenue multiplied by customer lifetime value.

It is important to note that the calculation of LTV (Lifetime Value) requires the use of historical data. It is based on average spending patterns, order frequency and other factors arising from the interaction between the customer and the product.

When calculating LTV, it is also important to consider other microeconomic factors such as churn and discount rates. These factors can have a significant impact on the final valuation as they take into account the overall sustainability of the customer and the time value of future profits.

3. Churn rate

The churn rate is the percentage of customers who have stopped interacting with the company in a given period. It is calculated using a formula that divides the number of lost customers by the total number of customers during the same period, such as a month.

For example, if a company has an average customer acquisition cost of $500, but finds that customers are leaving at a rate of 5% per month, this can result in a loss of revenue. To compensate for this loss, it is important for the company to take additional measures such as increasing customer satisfaction, launching advertising campaigns or improving services to retain and attract new customers.

As the company does not receive a return on its investment in attracting this customer, this will affect the LTV and reduce the LTV to CAC ratio.

4. The level of discounts (D)

Unit economics can be useful to businesses when formulating a pricing strategy, taking into account the level of discounts given to customers for their purchases.

The impact of different levels of discounts on the company's profit allows it to optimise its pricing system.

For example, if a company plans to offer customers a 10% discount on products, it needs to calculate the expected ratio of customer lifetime value (LTV) to customer acquisition cost (CAC) to determine whether such a discount offer is economically justified.

5. Average customer lifetime (ACL)

Not every customer is immediately profitable, so the average customer lifetime with a product/service has a direct impact on the economic performance of a unit.

The average customer lifetime is the average time a customer stays with a company and uses its services. It takes into account various factors such as customer loyalty and satisfaction, as well as purchase frequency and churn.

By analysing average customer lifetime, companies can calculate the lifetime value of a customer (LTV), which helps them better predict how long it will take to recoup their CAC costs and generate a return on their investment.

6. Customer Retention

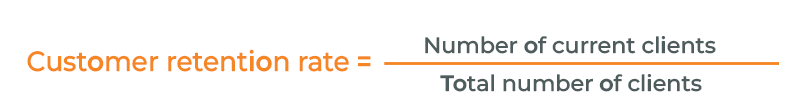

Customer retention is an important factor as it affects customer lifetime value (LTV). This is calculated as the number of customers who remain with a company for a given period of time (for example, one month) divided by the total number of customers during the same period.

It is important for companies to understand their customer retention rate in order to determine whether their products or services are meeting the needs of their customers and whether they are able to retain them.

If a company has a low customer retention rate, it indicates low economic efficiency per unit of output. This can only be remedied if the company can compensate with a high rate of new customer acquisition or increased profit margins.

7. Number of transactions (T)

The number of transactions is a small factor, but critical in the context of economic analysis. This indicator is calculated as the total number of purchases made by each customer during a given period, for example a month.

It is important to understand that a higher number of transactions does not necessarily translate into more direct sales. Companies with high product value may need fewer recurring revenue streams to achieve the desired lifetime value (LTV).

At the same time, companies with low-margin products may need higher transaction volumes to recoup their customer acquisition costs (CAC) and ensure a return on investment.

This indicates customer interest in the company's products. Customer data, such as the number of transactions compared to the LTV of customers, can be useful in developing better marketing strategies and pricing.

8. Number of customers (C)

When it comes to understanding the unit economics of a product, the number of customers becomes a relative measure. Like the number of transactions, the total number of customers a company has can help determine its profitability.

Companies with more customers can have more resilient unit economics per unit of output because they are less dependent on a single customer. This makes them more resilient to possible changes in the market.

Of course, companies with fewer customers should pay particular attention to LTV and take various factors into account when managing revenues. It is important to consider customer retention, transaction volume, discount rate and average customer life expectancy.

9. Total revenue (TR)

Total revenue is defined as the sum of all receipts from the sale of goods or services during a given period.

In financial analysis, total revenue is the starting point for assessing the economic value of a unit of production.

It should be noted that total profit does not always indicate profitability, as it does not take into account the cost of goods sold (COGS) and other expenses.

10. Gross profit (GP)

Gross profit is defined as the difference between total income and the cost of goods sold (COGS). It includes the costs of producing a unit of output, such as materials and labour, but excludes other costs such as marketing, overheads and indirect labour.

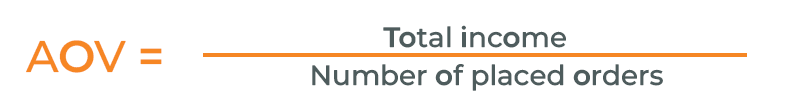

11. Average order value (AOV)

Average Order Value (AOV) is total revenue divided by the number of orders placed.

This metric allows companies to determine how many customers they need to break even, and how profitable it is to invest in acquiring new customers versus retaining and growing their existing customer base.

12. Average gross margin (AGM)

The average gross margin is calculated as gross profit divided by total profit. This measure helps to assess the profitability of each sale and how the cost of producing a unit of product changes over time.

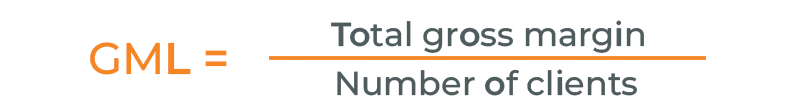

13. Gross margin per customer lifetime (GML)

The gross margin per customer lifetime is a key indicator that determines the total gross margin divided by the number of customers who interact with the company during a given time interval.

A low gross margin per customer may indicate the need to increase customer retention in order to run the business more efficiently. It may also be an important strategy for reducing production costs to achieve a positive ROI.

How is the unit economy calculated?

The calculation of the unit economy includes a number of key indicators mentioned above. The basic formula for calculating unit economics is as follows

Unit economics = revenue per customer / customer acquisition cost

The revenue per customer is calculated by dividing the total revenue of the company by the total number of customers.

The cost of customer acquisition can be complex and include various variable costs, depending on the specific business model and strategy. It is usually calculated as the sum of various components such as marketing costs, product costs, customer service costs and other costs associated with customer acquisition and retention.

Analysing unit economics

Applying the concept of unit economics can help companies effectively price their products and analyse their financial performance.

Fixed costs versus variable costs

Fixed costs remain constant regardless of the volume of goods or services sold. They include overheads such as rent, insurance and labour.

Variable costs vary with the volume of production. These costs include materials and labour used to produce a product or service.

If a company attracts more customers or increases its output, it will increase variable costs such as materials, labour and delivery costs.

If the increase in both fixed and variable costs is proportionately less than the new revenue generated by attracting customers, then the business has a very good chance of achieving a positive ROI. This means that the profit generated by the increased volume of business is greater than the total increased costs. This situation allows the business to make a profit and achieve a positive ROI.

LTV to CAC ratio

When analysing the unit economics of products, LTV and CAC are important indicators that allow you to estimate the cost of customer acquisition and its potential revenue for the business.

The optimal ratio of LTV (Lifetime Value) to CAC (Customer Acquisition Cost) is considered to be 3:1. This means that for every unit of customer acquisition cost (CAC), three units of value are expected to be received from that customer throughout his or her 'life' as a customer of the company.

If the ratio of LTV (Lifetime Value) to CAC (Customer Acquisition Cost) is less than 1:1, this may indicate problems in the business model. It means that each new customer is worth as much or more than they will spend on your product. In this case, it is recommended that you carefully analyse your customer acquisition strategy, improve your sales methodology and improve your pricing models.

A higher ratio, such as 6:1, indicates a potential missed opportunity. A customer may generate more revenue than the cost of acquiring it. In this case, there are more opportunities to increase sales and marketing spend to acquire more customers without incurring additional costs.

CAC Payback Period

The payback period is the time it takes for a company to recoup the cost of acquiring a customer.

A company spends money to acquire a customer and the payback period is the time it takes to recoup that cost.

For example, if a company spends $500 to acquire a customer and receives $1,000 in recurring revenue from that customer over the next six months, the payback period is six months. In that time, the company will have recouped its customer acquisition costs.

The average payback period for startups is about 15 months. This means that companies need to retain customers for at least that long to recoup their acquisition costs.

How can unit economics be improved?

As the unit economics equation has many variables, companies can improve it in a number of ways:

- Increase revenue per customer

- Reduce customer acquisition costs

- Increase customer retention

- Reduce the cost of goods sold

- Invest in product improvement

These aspects can be improved by using more effective marketing strategies, increasing product value, optimising the cost structure and improving the customer experience.

It is important to note that an improvement in one element (e.g. an increase in revenue per customer) and a deterioration in another (e.g. an increase in unit costs) can result in a negative value for the specific economic efficiency equation.

Questions and answers

Why use unit economics?

Companies use the concept of unit economics to assess the profitability of each customer they serve, as well as to analyse their overall financial performance. Unit economics allows companies to identify and eliminate inefficiencies and make informed decisions about pricing, marketing, product development and other aspects of their business.

How do you calculate unit economics?

The first step in calculating unit economics is to clarify what the unit of analysis will be. In the case of a SaaS business, it is advisable to consider the company and all its subscriptions as a single unit. This is particularly important if your aim is to serve other companies (B2B business).

However, if it makes sense for your business, you can also treat individual subscriptions as separate units of analysis. Once you have defined the unit of analysis, calculate the revenue that the unit generates over the lifetime of the customer and divide it by the cost of acquiring the customer. This will give you a basic measure of the economics of the unit.

However, it is best to use the projected lifetime value (LTV) or flexible LTV options discussed above to calculate the economics.

How can you improve unit economics?

There are two ways of improving unit economics. The first is to spend less on sales and marketing. This is not the best way as it slows down growth. However, sometimes you have to limit spending, and if the LTV:CAC ratio is too unbalanced, it makes sense to cut the budget.

There are two ways to improve unit economics. The first is to reduce sales and marketing expenditure. It is worth noting that this is not always the best way, as it can lead to a slowdown in growth. But sometimes, if the ratio of LTV (customer value) to CAC (cost of customer acquisition) is unbalanced, cost containment can be justified.

A better and more sustainable way to improve unit economics is to increase LTV. ProfitStore will be a key partner in helping you analyse your data, significantly improve your performance and ensure more sustainable growth of your business through end-to-end analytics.

SHARE

OTHER ARTICLES BY THIS AUTHOR

Get the most exciting news first!

Expert articles, interviews with entrepreneurs and CEOs, research, analytics, and service reviews: be up to date with business and technology news and trends. Subscribe to the newsletter!