LTV: how to calculate and use in marketing

It is hard to imagine any business without customers. They are the backbone of economic activity as they buy products or use services, or pay for them, which is a source of profit for the company. This motivates entrepreneurs to actively acquire new customers, investing significant resources in the process.

LTV (Lifetime Value) reflects the long-term value of a customer to a company. It measures the total revenue received from a customer over the entire period of the relationship, from the moment the customer is introduced to the product through advertising or registration on the website to the last purchase.

The LTV value has a direct impact on the company's revenue: the more loyal customers, the higher the financial result. However, it should be analysed in the context of other important business metrics.

A high LTV is only positive if it exceeds the cost of producing, acquiring and retaining customers. If the costs are higher, it is a signal to review the business development strategy.

Why you need to calculate LTV

LTV (Lifetime Value) is one of the key indicators in marketing analytics that plays an important role in increasing revenue and optimising costs. By using LTV, you can achieve the following goals

- Identify the customers that generate the highest and lowest revenue to optimise the distribution of attention and investment;

- Determine the amount of investment that can be made in the business and estimate its payback period;

- Focus on strategies to retain existing customers;

- Evaluate the effectiveness of marketing activities, identify sources of customer acquisition and reduce the cost of ineffective advertising.

As such, LTV is an important business management tool that not only increases profitability, but also significantly improves the efficiency of resource spending.

Types of LTV

Lifetime Value (LTV) is used in two main formats:

-

Predictive LTV allows you to estimate the potential value of both future and existing customers to identify the most profitable ones. This analysis is used to develop strategies to attract and retain customers, for example by offering bonuses, discounts, free delivery or other privileges that increase customer loyalty.

-

Historical LTV is based on data from interactions with past and present customers to assess their contribution to the company's profit. This information helps to predict the behaviour of current customers and to plan marketing and sales strategies effectively. Historical LTV is often used in industries with short-term customer relationships, such as online course sales.

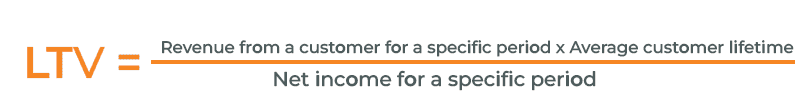

LTV calculation formulas

There are several basic approaches to calculating Lifetime Value (LTV) that can be adapted to the specifics and size of a business. The complexity of the method depends on the number of factors taken into account. Here are some of the more commonly used formulas:

Simple LTV formula

To calculate the lifetime value (LTV) of a user, you need to determine two key metrics: ARPU (average revenue per user) and lifetime (total time spent interacting with a customer). ARPU is calculated by dividing the total revenue for a given period by the number of users who made purchases during that period. Lifetime represents the total time a customer spends making purchases. The LTV formula is derived by multiplying ARPU by the total time spent interacting with the customer, which allows us to estimate the total revenue generated by a user.

LTV = ARPU х Lifetime

Advanced LTV formula

This approach to calculating Lifetime Value (LTV) involves forecasting future customer income based on a more complex formula that takes into account several key economic indicators:

LTV = GML / (R/(1+D-R))

де GML (Gross Margin per Lifetime) означає середній прибуток від одного клієнта за весь час співпраці з компанією. Цей показник визначається як добуток коефіцієнта валового прибутку (AGM) на середню вартість замовлення (AOV) за певний період.

R is the retention rate, which measures the percentage of customers who continue to make purchases. It is calculated using the formula

R = (customers at the end of the period - new customers during the period) / customers at the beginning of the period.

D represents the average discount offered by the entity or, in the context of long-term forecasting, the discount rate. The discount rate is used to calculate the present value of future cash flows, taking into account the time value of money.

LTV cohort analysis

For a more detailed analysis that takes into account the behaviour of groups of customers over time, cohort analysis is used. This approach allows you to calculate the LTV for specific groups of customers based on their time of engagement and behaviour.

The lifetime value (LTV) of users who have registered on the website can be calculated for different time periods: hours, days, months. Once the relevant cohorts have been created, average revenue per user (ARPU) analysis is performed for each group. This is done by summing the revenue received from all customers in the cohort over a given period and then dividing this amount by the total number of customers in the group. LTV is defined as the sum of all ARPU for the entire period of a user's purchases on the site.

Norm for LTV

Establishing a universal norm for Lifetime Value (LTV) is indeed a difficult task due to the uniqueness of each business. The diversity of industries and business models leads to significant variations in cost and revenue structures, which in turn affect optimal LTV values.

Rather than focusing on generally accepted norms, a more effective approach for companies may be to monitor and analyse the dynamics of LTV over time in the context of their own business. This will allow you to identify trends and effectively allocate marketing budgets and resources to optimise customer acquisition and retention strategies. The ultimate goal is to continually increase the value of the customer base by increasing the profitability of each customer and reducing the cost of acquiring and retaining them.